While Greece headlines about the referendum are everywhere, what is the data telling us this week?

When Tsipras announced a referendum last week the market response was obvious: risk off. Uncertainty is the market’s kryptonite. We observed an expected sell off in EUR pairs, while JPY saw massive inflows, and so did USD, albeit more modestly. Yields plunged as well. And yet at the end of the week, despite the referendum approaching and the incertainty of the outcome, it was as if business as usual.

I was therefore eager to check the COT report.

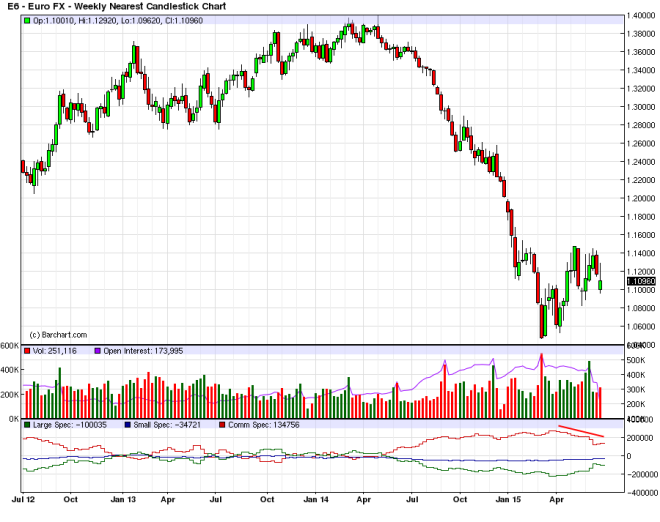

Commercials still reducing their longs USD…

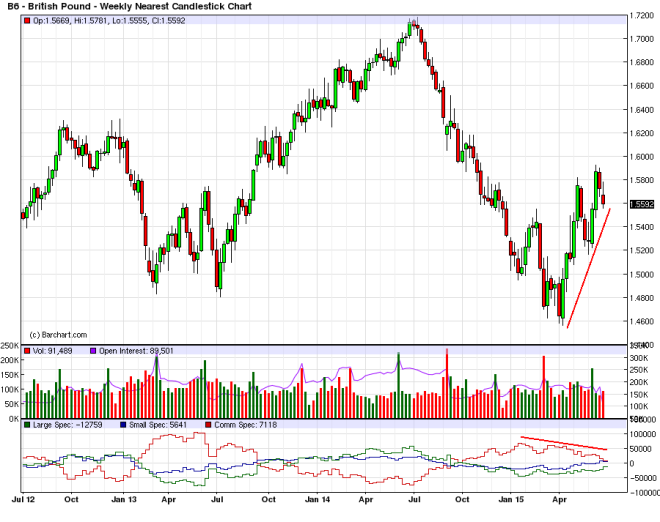

… while reducing their shorts EUR and GBP. Don’t look at the latest data point, lookt at the trend. They’re merely pausing in the EUR trend, as if the impact of the greek referendum was unsignificant. And they’re on the verge of starting building longs GBP.

Maybe the most interesting thing is the JPY reaction: while Commercials were re-accumulating shorts they stopped 2-3 weeks ago. And yet, the JPY is floating again, just like it did for months. Given the size of the short reduction it “should have” soared. But it didn’t. As i said before, only the BOJ has enough juice to do something like that. I don’t want to play oracle because any significant risk-off even could happen any day, but as far as i’m concerned the BOJ is driving JPY to the toilet.

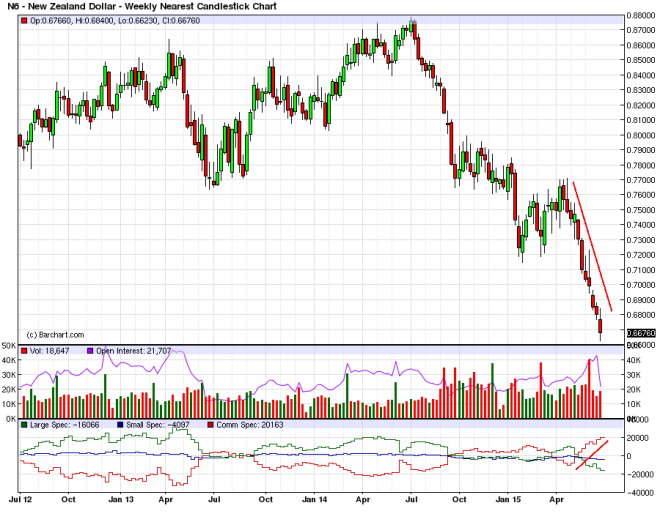

Finally, Commercials are rebuilding their shorts in CAD, AUD and NZD, with NZD taking the cake, by far.

I am not a seasoned trader, therefore i will probably stay on the sideline at the open, but i’ll be there, watching what’s the market reaction to whatever the news coming from Greece and the institutions are.

Good luck if you’re trading. Try no to get caught up in the excitation of the moment, trade your edge and manage your risk accordingly, always protect your capital.