I funded my first live account one year ago, knowing i wasn’t ready yet. Let’s review what happened since then, where i’m at now and what the next step is.

My trading journey started in business school, when an ex student now independent trader came to do a presentation. I’ve always been interested in the markets. When i was a kid we had the morning news on the radio for breakfast. The stock market was the only section I was interested in. But i never pursued it, nobody in my family knew anything about finance. So it was by chance that the flame was rekindled, years later, when this guy agreed to present his job to a few students. I don’t think we were even 15 there to listen to him. But he was showing charts, candlesticks, he was talking about stocks, indices, currencies. I was instantly hooked. I started reading all i could find about japanese candlesticks, starting with french litterature on broker’s websites. But then i had a semester abroad, i was also very involved in a french webzine on electronic music, years before America ever heard EDM for the first time. I was partying a lot, meeting promoters, artists, agents, i went to countless festivals, we were offering tickets to nightclubs in Paris, Brussels, Lille (my hometown), festivals everywhere in France, i even went on tour with some artists. They’re quite big now, but then 150-300 people to a gig were all we were asking for. So trading was not #1 in my mind. After the business school i immediately got a job with 2 friends whom i met while i was a student in what became our HQ, the only local nightclub that booked artists every week, who had a truly artistic vibe. They were into music, i was too. I was in fact recruited on the spot, at the bar, when they asked “What are you doing now” and i told them i was just back from my semester abroad and looking for a job. The job? Ironically, trader, of fast moving consumer goods. The difference with trading the markets? You only buy if you already have someone to sell to. We did 4 years together. I learnt a lot. But that was not my passion. I was not particularly good at it. Towards the end i was spending more time reading about trading than actually trying to find new suppliers or new clients. So when the structure of the company changed to focus more on the independent supermarket they had and which i was already helping managing a lot, they offered me a spot there. I took some time to think about it but decided at nearly 30 years old it was time for something else. So we parted ways. They closed shop altogether 7 months later. Let’s just say France is not business friendly, especially when you already have companies in 3 or 4 other european countries. They couldn’t be bothered anymore, i felt it and that’s why i decided to leave.

So here i was in july 2015, with 2 years of guaranteed allowance thanks to the government. I was (am) still relatively young, i had some free time to focus on trading, let’s do it! I wasn’t ready by any mean to trade live funds, but as mentioned then we’d just sold a house and had some money, so why not invest in me if it’s working, rather than just park the money for 2-3% at the bank.

You often hear that you should have realistic expectations when you start trading. They say you should not expect to double or triple your money every month, or even every year. But you never see them actually telling you what a realistic expectation is. So let’s do something i’ve never seen anyone do before. Let’s share openly my results for my first year, and analyse them.

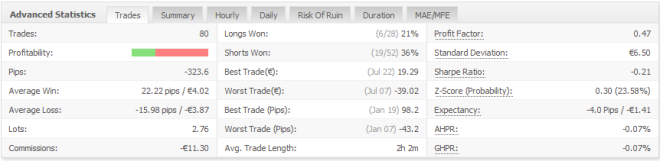

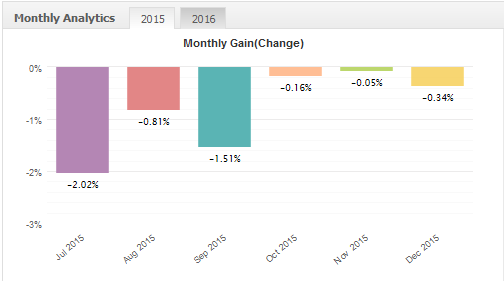

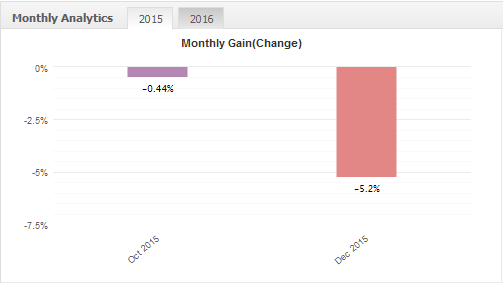

I opened the account on July 3rd, 2015 and my first trade was on July 7th. Straight 2% risk, i wanted to get it over with. In hindsight i should have started with the smallest size possible, 1 micro-lot, and grow from there but 2% i risked and 2% i lost. I knew managing risk was everything, i’ve never really had to fight this, it feels natural to me. I knew i must protect my capital, and that consistency would save me, not doubling down after a losing trade. I also knew i didn’t really know what i was doing and survival was the goal at first. So i cut my risk in half, risking 1% then 0.5% until i reached the minimum trade size possible: 1 micro-lot. I finally got a winner in late july, then some more losers, until a big one on August 20th. I remember that one too well. It was a case of mixing 2 trading strategies, at an awful level, at an awful time of day, widening my SL, with too big size. Overconfidence, naïveté, plain and simple. I lost 1.18% and felt so bad i promised myself never to do it again, ever. It felt much worse than the first 2% loss. I read the market wrong and took a loss. But on august 20th i did everything i was taught not to do. I felt like such an idiot i was ashamed with myself. It’s interesting to note that the next trade on august 31st was a winner. I only lost 0.81% in the month. Then a long period of doubt, unable to find setups, i was still going through the teaching material that i was feeling confortable with. It felt like i would never make it, that it was too big a task, herculean. It had been 3 months already and all i could show was losses, except 1 or two winners. That was a tough period bud i kept grinding, trying to tip my toe with tiny trades here and there. I kept going.

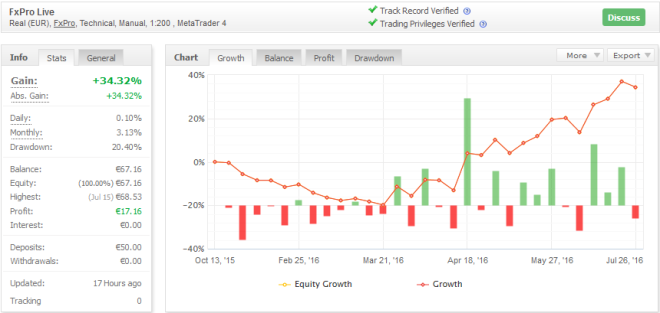

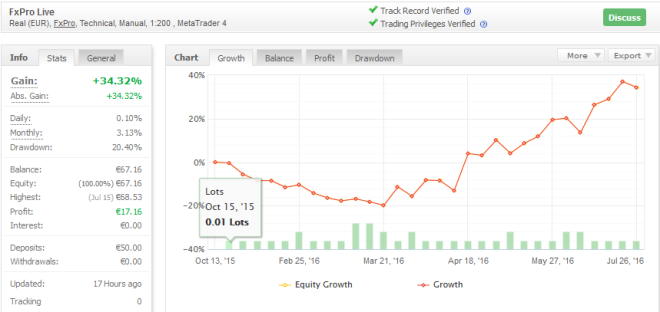

In october i opened a 2nd live account with a different broker, just to get access to their live feed on the platform i was charting with, because i noticed the demo feed i was using was not reliable. I funded it with 50€ and decided it would be my “have fun account”.

I want to highlight the fact that i’ve never traded more than 1 micro-lot at once on this second account. The rare occasions when you see 2 or 3 micro-lots traded are when i took 2 or 3 trades the same day. The results, 20% drawdown and 34% gain, are only relative to the ridiculous size of the account, 50€.

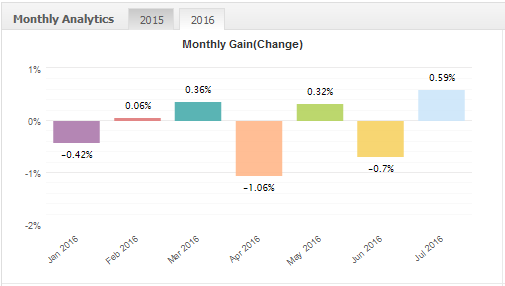

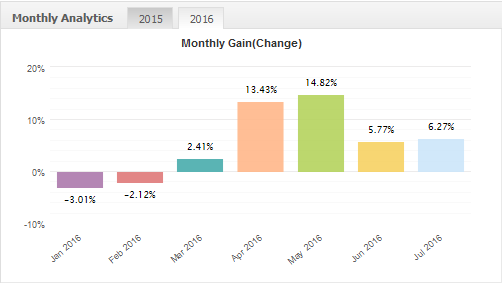

You can see that on both accounts the equity curve was pointing down until late february/march. “When you’re going through hell, keep going”. Finally results started to improve. The curves are not similar because i had a more relaxed, careless approach with the small “have fun” account, and took trades i wouldn’t really take on the “main” account. I don’t think it’s due to “bigger account, bigger risk, fear, plain and simple” because i was trading the same size, the minimum size, on both accounts. No, rather i think it’s due to the main account being the “showcase” account. It’s fear of losing alright, but not losing money, maybe more losing face.

In April i felt confident i knew what i was doing and decided to fix my size on the main account. I already talked about it in my previous post Random Trading Observations, so allow me to copy and paste it here:

Position size. I started with a 2000€ account in july 2015, reduced gradually my size to 1 micro-lot to ride the learning curve and still play with live funds. My equity curve made a low in January 16 at 5.49% drawdown, then it was higher lows, and pointing up, but still underwater. In april i did the math to find the smallest position size that would cover all scenarios on every instrument with my widest SL. I would finally have a fixed position size, now that i thought i knew what i was doing. Indeed, since my priority was to reduce risk, i would trade 1 micro-lot with a 20 pips SL on EURUSD (0.09€/pip) just as i would on EURGBP (0.13€/pip with a 30 pips SL). So a 2R winner on EURUSD would not cover for the 1R loss on EURGBP. It was not the point until then, i was merely trying to figure out everything else. So i did the math, and fixed my position. Unfortunately the first week i did that i read the market completely wrong and took 3 losers, which quickly made new lows on my equity curve. But what i was really satisfied with was my mindset. It didn’t bother me at all. Because i know sometimes i won’t get it right, but when i will i’ll quickly overcome that. Indeed, the next trade after that was a 2.xR winner and covered more than 2/3 of the previous losses.

We’re now July 30th 2016, one year later. I think i can say i survived my first year. I have started my seventh notebook for my journal, i have pages and pages of notes, countless screenshots of setups, market structure study, examples of what works and what doesn’t. Obviously my knowledge has improved tremendously. I know the markets better. But more importantly i know myself better. It’s starting to look good or at least promising. One equity curve is looking relatively sexy but the other one is just “meh”. I must admit i’ve felt the temptation to up the size of the main account back to 2% recently, to get back above breakeven quicker. So far i’ve managed not to give in. I shall scale up at the same levels i scaled down, and not before. Consistency is the key.

My main problem now is undertrading. I’m very selective of the trades i take, which is a good thing according to experienced traders. I agree, if you have a big ass account, money on the side, other sources of income, and time. Almose none of which i possess. I don’t see myself making a living out of this within the next 12 months. Not on my own, or not without overleveraging. Either i convince a prop firm to recruit me, and i show enough to trade from a larger account, or i’m gonna need to get another job, which is gonna be a problem for the way i trade the markets, which is more like daytrading. The second problem, which is a derivative of the first one, is that i have very few opportunities every week. It is thus crucial that i don’t miss them, and that i act on them. I do if i see them. But the area of improvement is clearly on the daily routine. I may miss one because i’m looking elsewhere. This week i missed one because i was hungover, not 100% focused, as i should have been. Knowing me i know being alone doesn’t help. I need structure, energy around me. That’s why i really think a prop firm would be a good fit for me at this stage.

Notes :

- I’ve skipped the part where i spent thousands euros on trading systems and courses. It was not relevant here, but i did. I went through that as well when i was working and studying the markets at night. I want new traders to know that. You don’t need money to succeed, there is enough free material to learn, but it’s gonna require work. A lot of it. Probably more than you imagine.

- Books. I’ve read Market Wizards by Jack Schwager (on my iPhone during my lunch breaks while i was working, i bought the paperback book since then), Trading in the Zone by Mark Douglas, Trading for a Living by Alexander Elder, i’m halfway through Trading Psychology 2.0 by Dr. Brett Steenbarger, i’m also reading Jesse Livermore’s adventures in Reminiscences of a Stock Operator at the same time. The next in the list is The Trading Athlete, as recommended by a prop firm owner.

- I’m curious to see if i’ll get some trolls on my results. I suppose real experienced traders will be able to tell, and that’s all that matters. I will share statements and links to the myfxbook pages to legit requests only. If you’re a prop firm and you have a free spot, hit me up. If you don’t want to teach a kid from scratch but rather help a fellow trader grow and reach his potential, hit me up as well.

- The 2nd account is on fundseeder (Schwager’s venture, TA8655769). I have little faith anything will come of it given the 20% drawdown but i intend to keep trading it to see how far i can get it.

Some resources i would recommend to a new trader:

Mind

- Everything Dr. Brett Steenbarger has ever written. His books, his blog, his Forbes column, his twitter account.

- Van Tharp chapter in Market Wizards, and the Psychology chapter in Trading for a Living.

- Trading in the Zone and The Disciplined Trader by Mark Douglas

Money

- Tradeciety, Steve Burns are a good start. ICT as well.

- Lance Beggs is a fantastic resource. I don’t use his strategy, but i like its goal (meta game), and everything else is gold, from trading journal to process, routine, mindset, reviews, risk management, etc. A must follow.

- BreakingOutBad. Tough, needed love.

Method

- If you’re trading Forex there is only one person i can recommend, and that’s ICT. Everything else, and i do mean everything, is garbage (unless it works for you). Everyone who has bothered going through the material will vouch for it. But there’s a lot of it and it will take hundred of hours. You’ll need to go through it several time as well. It’s like a good book. Every time you read it you find something new. That’s how good his material is. The haters haven’t done the work, they just focus on his twitter account and whatever demo account he blew up.

- If you’re trading stocks, ICT has some material as well, but maybe Steve Burns and Assad Tannous are more what you’re looking for.

- If you’re trading futures, i’d go with Lance Beggs, and ICT, him again.

- If you’re trading Bund, God help you. It’s Tom Dante‘s speciality. I was part of his live room for several months, i can vouch for him. His twitter is mostly entertainment, but there is the occasional good trading tweet, and his weekly webinars are very good and highly recommended. He covers forex and Bund, but also process, mindset, etc. This week webinar “will cover how to survive your first year trading, prosper in your second and smash your third.” Needless to say i’m quite eager to watch it.

Records Keeping

- Bic, Oxford, thank you, i couldn’t have done it without you.

- Edgewonk for tracking your stats. It will help you identify your strengths and weaknesses like nothing else. Highly recommended.

- Myfxbook, it’s good enough to have a rough idea, it’ll give you stats you don’t need, and because you don’t have to do anything you’ll overlook certain valuable details about each trade. Use Edgewonk, and Myfxbook to complement.

Loved reading that post, really enjoyed that journey. Have you tried darwinex or axiselect?

Good luck with your trading.

LikeLike

Thanks Hanz. I know about Darwinex but i haven’t created an account yet. I suppose i’ll look deeper into it in the coming months.

Never heard of Axiselect, i’ll look into it as well, thanks for the suggestion.

I saw your 2nd message, i think i manually have to approve comments before they appear, hence the delay.

LikeLike

Good read. I was in similar situation with Forex, I was profitable but only if I was highly selective with my trades but the number of trades per week was not enough to earn a living from with my account size.

So I moved to futures and a lower time frame. That meant that I had to relearn a lot especially on the mental side and improve my processes.

I wish you the best on your journey.

Adey

LikeLike

Thanks for the feedback Adey. Your processes and your blog are impressive and inspiring. You clearly deserve success.

I intend to educate myself on futures as well at some point in my career, maybe i should do it sooner rather than later. For now i’m afraid it’ll just confuse me even more but it’s definitely something i’m keeping in mind.

LikeLike

Thanks for the kind comments.

Changing from forex to futures is definitely a double edge sword. I thought as I was profitable that it would take a few months to maybe six months to get established in futures. But it took a year to just to get where I was in Forex and another year to do better. I seem to be on the right path and I am definitely a better trader.

But the question is how far down the line would I be if I just stayed in forex for those 2 years and worked on my system and process. Purely money wise I would be better off with the compounding, would I be as developed as I am now trader wise. I am not sure, switching to futures and lower time frames does mean that the process and mental game have to be a lot more developed than when I was trading the hourly and daily in forex.

So I definitely would not recommend changing blindly. There is a lot to be said of focusing on one type of market and becoming the best you can be at trading your system in that market.

Good luck mate

Adey

LikeLiked by 1 person

Hey there

I really enjoyed the post

But as u recomended ict specialy for forex

I went through his 6 videoes there is no technical analysis just talking about intermarket analysis

I mean nothing practical .

Does he have courses to go through?

Thanks wish you good trading life

LikeLike

Yes, digg on his website, look for the tutorials page. I agree his website is not the most practical.

When you’re on the homepage there’s a slideshow, from 1 to 5. Start with 1, wait one second, the link for the first 6 videos appears. Then click on 2 (or wait for the slideshow to automatically get there), wait one second, you’ll see the link to the “ICT Library” appear as well. That’s were the bulk of the teaching is. 3 is pdf files, only 3 out of 4 links work as far as i know. Back to the homepage, 4 is weekly reviews, it hasn’t been updated in years, check his twitter and youtube accounts instead. Finally 5 is the testimonials.

Hope that helps.

LikeLike

I should also refer you to Sqa’s marvelous guide to ICT material on fxgears: http://fxgears.com/forum/index.php?topic=410.0

LikeLike

Thanks for sharing, and i really enjoyed reading this blogpost.

I am a ICT student too, and i love his concepts, it was a bit overwhelming at first, but i have landed on the turtle soup + breaker for my plays. And order blocks.

You did a great job at surviving year 1, not alot of traders actually manage to get where you are.

Keep up the good work!

Best wishes

Norse

LikeLiked by 1 person

I appreciate your transparency and honesty here, which is something the industry and community lacks. Thank you for sharing, from what I know, being humble and transparent are very important traits for becoming successful, especially in the markets, where we cannot afford any illusions. I look forward to hearing about your success in your second year.

All the best,

David Taylor.

LikeLiked by 1 person

Thank you!! Interesting read! Always love a trader’s journey!!

LikeLiked by 1 person

Hi, great blog! Have you looked at nobrainertrades.com material as well? If so what do you think of it? It’s very similar to what ICT is teaching.

LikeLike

Thanks. No i haven’t, i can’t say.

LikeLike

You haven’t tried the ICT mentorship program? If so did you like it? Thanks!

LikeLike

Hey,

Great article ! , I can relate to what you have been going through, Its a tough job not having a income source , still need to be super selective on the trades and by the time you get a very good day you are out of focus :P , it happnes. I am in the same boat as you ,

the biggest problem i face is taking trades that i shouldnt have taken or missing out some good trades because they are at higher risk , to overcome this i have started trading more trading instruments so that i dont have to dig for trades in limited charts

All the best , Keep writing more.

LikeLike